Money That Moves You: 5 Steps to Budget with Confidence When Starting Your Practice

When you’re building a practice — especially in the early days — your energy goes everywhere. You’re naming your business, finding a space, setting up software, and serving your first clients. But one thing can quickly become an emotional bottleneck: your money.

Budgeting isn’t just spreadsheets and numbers. It’s clarity. It’s control. And when done right, it can actually feel empowering. That’s where Aseel El-Baba comes in.

Aseel is a financial therapist who helps business owners understand not just what they’re spending… but why. In this playbook, she shares 5 steps to create a simple, values-aligned budget that gives you peace of mind and room to grow. Whether you’re just starting out or reevaluating your foundation, these tips will help you make money decisions with more intention, and less fear.

Let’s get into it.

Aseel’s Playbook for budgeting when you’re starting a business

Tip #1: Know the Basics

- Action: Identify your minimum monthly living expenses and business costs. Include fixed expenses like rent, utilities, and any essential business expenses, as well as variable expenses like groceries, entertainment, etc.

- Why it helps: This gives you a clear understanding of your baseline financial needs, helping you set realistic revenue goals and avoid unnecessary stress. Knowing your essential numbers also reduces the fear of the unknown (also known as anticipatory fear, which creates unnecessary anxiety).

- Pro tip: Separate your personal and business expenses into two accounts from the beginning to maintain financial clarity and make it easier for yourself during Tax Season.

Tip #2: Keep it Lean

- Action: Focus on the activities that drive revenue and avoid over-investing in unnecessary tools, services, or branding during the early stages. Use free or low-cost resources when possible. As tempting as a full-out branding package can be (trust me, I’ve been there), know the minimum viable products you need to get your business going. Plus, your branding might change in the early stages as you test yourself and the market.

- Why it helps: By keeping your startup costs low, you’ll reduce financial strain and give yourself a longer runway to grow your business. This also minimizes early financial regret or debt accumulation.

- Pro tip: Adopt the 80/20 rule: 80% of early results often come from 20% of your efforts. Find out what these core activities are and invest only in what directly impacts your revenue.

Tip #3: Grow Your Peace of Mind Fund

- Action: Save at least three to six months' worth of business and personal expenses in a separate savings account. I like to call this “Peace Of Mind” instead of “emergency fund” because I believe words matter, and part of healing our relationship to money is reclaiming how we refer to and relate to our accounts.

- Why it helps: Having a financial safety net allows you to weather slow months and unexpected challenges, giving you the peace of mind to make better business decisions. Also, when you set this account with this intention, you won't feel like you are eating into long-term savings, which could be anxiety-inducing.

- Pro tip: Automate your savings. Set a percentage of your monthly revenue to be automatically transferred to a POM fund. You can also get creative in what to call it and find more aligned names that serve you

Tip #4: Pay Yourself

- Action: Set a specific amount to withdraw each month as your salary, based on your lean budget and projected income.

- Why it helps: Many entrepreneurs reinvest all their income back into the business without paying themselves, which leads to financial burnout. Paying yourself helps build a sense of financial security and motivates you to stick to your budget. It also reinforces the idea that your business is sustainable and worth your time.

- Pro tip: Start small and adjust as your income grows. You are building the habit of compensating yourself, even during slow periods. You are also expanding your understanding of concepts like worth, value, and deservability, all of which come up when we become business owners.

Tip #5: Become Very Intentional

- Action: Before making a financial decision, pause and ask yourself: Am I being motivated by fear, greed, or scarcity, or by love, abundance, and freedom? Invest in yourself and your business, but ensure that every decision is made with strategy and clear intention, not just in what you do, but why you do it.

- Why it helps: When financial decisions are made reactively — out of fear of failure, comparison, or a scarcity mindset — they often lead to unnecessary spending, hesitation, or unsustainable choices. These are the choices I usually end up regretting. By shifting to intentional decision-making, you align your money with your long-term vision and values, reducing regret and increasing financial empowerment. It is a game-changer!

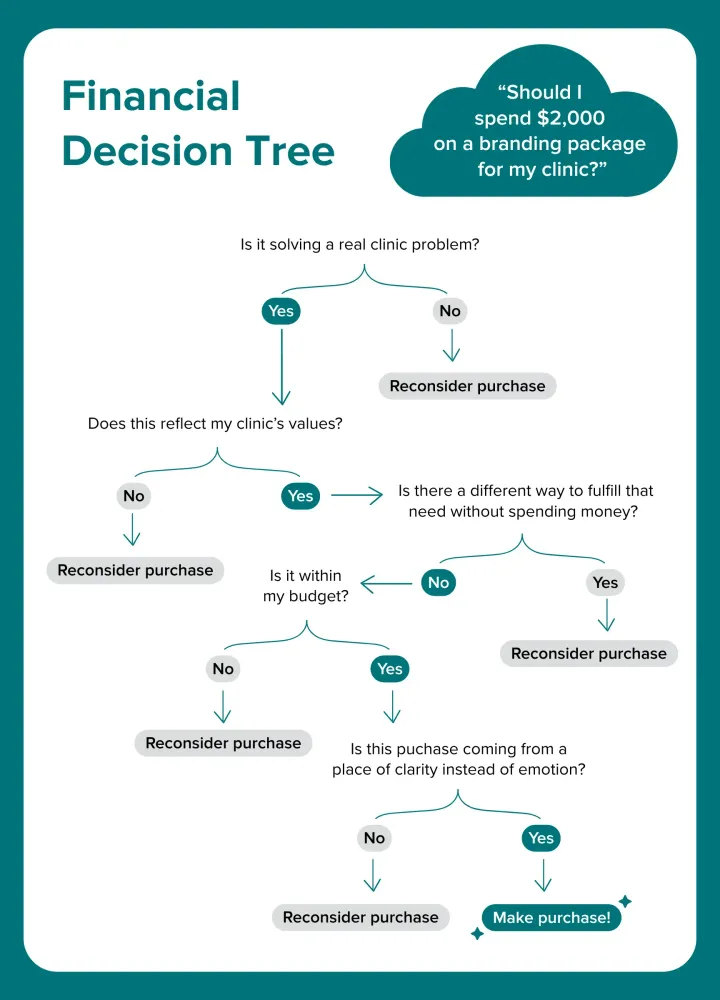

- Pro tip: Ground yourself with some breaths and create a simple decision-making filter: If a financial choice doesn’t support your vision, values, or well-being, reconsider it. Here’s what this could look like:

Want to feel even more confident with your money?

Money touches every part of your practice, but you don’t have to figure it all out alone. In her episode of Radio Front Desk, Aseel shares the deeper why behind your numbers and how to shift from fear to clarity.

Give it a listen — while you’re walking, working, or balancing your books 💡